The No Surprises Act, which went into effect on January 1, 2022, provides balance billing protections for patients while simultaneously creating new ways for them to understand their financial responsibilities. It is essential that practice managers and providers understand the implications of this new legislation, and develop procedures to meet the necessary requirements. In this article, I will discuss 3 primary components of the Act, namely, billing regulations, price transparency, and patient protections.

Billing Regulations

Surprise medical billing (ie, balance billing) occurs when patients receive care from out-of-network providers or facilities and the service costs are not fully covered by the patient’s insurance provider.1 Patients may then receive bills that they were not expecting for services they assumed were covered. These include services provided by ancillary providers (physicians and non-physicians in emergency medicine, anesthesiology, pathology, radiology, laboratory, and neonatology areas), as well as items and services provided by assistant surgeons, hospitalists, and intensivists.1

For services that cannot be balance billed, the health plan and provider are encouraged to work together to agree on the payment amount. If they are unable to do so, both parties would then traverse the new Independent Dispute Resolution (IDR) process.

Initiated disputes require an administrative fee of $50 per determination (nonrefundable) and a fee of $200 to $500 per determination that will be refunded to the party whose offer is accepted by the IDR arbiter.

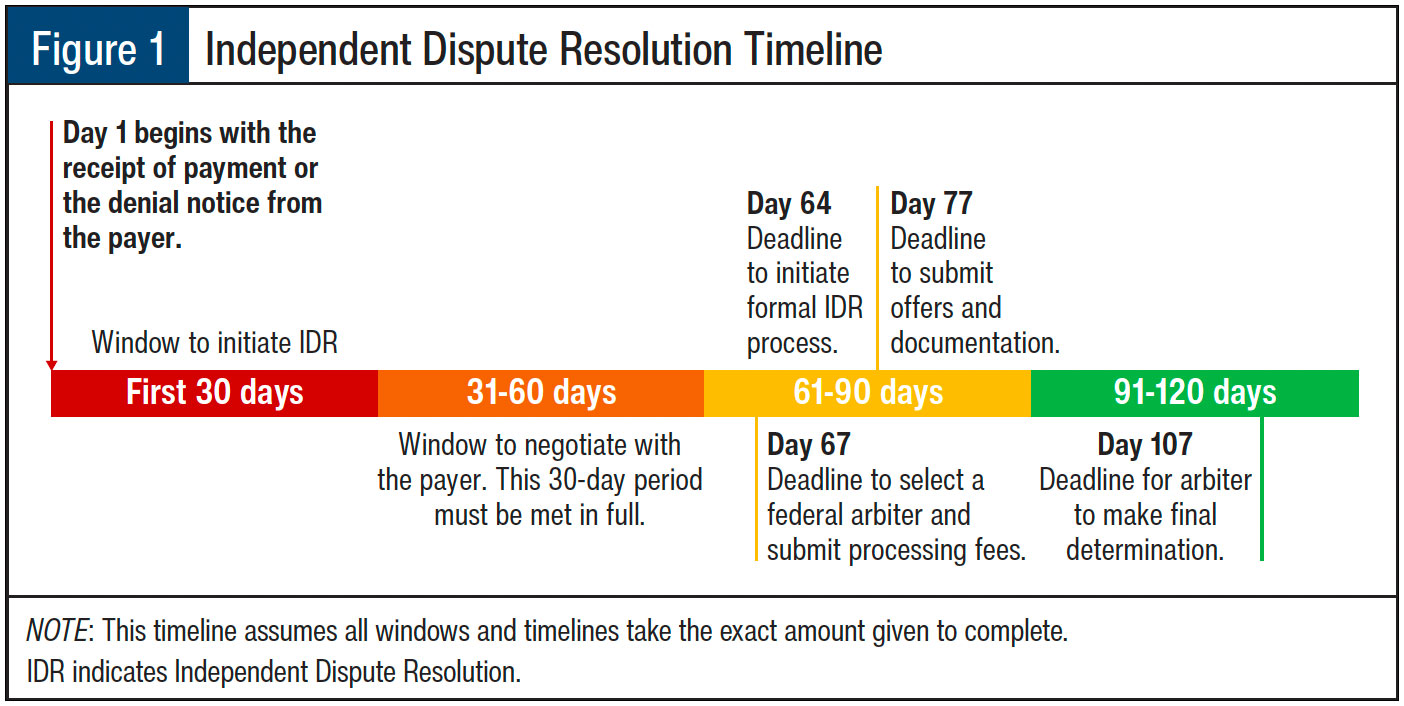

As shown in Figure 1, the IDR process follows a very specific timeline that the payer, arbiter, and provider must adhere to. Further details regarding this process are outlined below:

- Provider receives notice of payment amount or denial.

- Either party then has 30 days to initiate the IDR.

- This begins a 30-day negotiation period where the provider and plan attempt to find agreement on their own.

- After that period is exhausted, the formal IDR process may be initiated within 4 days.

- Once the formal IDR process starts, the parties have 3 days to select an arbiter (this must be a federally certified arbiter who has no conflicts).

- Within 10 days of selecting the federal IDR arbiter, each party must submit their offers and supporting documentation.

- The arbiter is required to make a final payment determination within 30 days of being selected to arbitrate (see Figure 1).

Notably, out-of-network providers at in-network facilities may provide notice and consent of the intention to balance the bill when all of the following conditions are met:

- The patient has been notified the care is out-of-network.

- The patient has been given other in-network options at that facility.

- The patient has received the estimated cost of care.

- The patient has opted to continue with the out-of-network provider.

Price Transparency

The goal of price transparency is to provide patients with all of the information they need to make an informed decision regarding out-of-network care so that they can avoid being surprised with large medical bills. The intent is to improve patients’ understanding of the total cost of care, provider networks, and insurance plan cost-sharing. To achieve this objective, the US Department of Health and Human Services (HHS) implemented the Good Faith Estimate (GFE) requirement, which went into effect January 1, 2022. The GFE is a patient-facing document that identifies the cash price for services less any discounts and the total cost of care by the provider for that period of care.

Who Should Be Provided with a GFE?

All physicians or other healthcare providers who act within the scope of practice of that provider’s license or certification are required to provide their uninsured (or self-pay) patient with a GFE. There are certain exceptions by insurance type where there are other patient protections against high medical bills.

When Should a GFE Be Provided?

A GFE must be provided to patients whenever they request one or when the service is scheduled. If the service is scheduled more than 10 days in advance, the provider must provide a GFE within 3 business days. If the item or service is scheduled within 3 business days in advance, a GFE must be provided within 1 business day.

Patient Protections

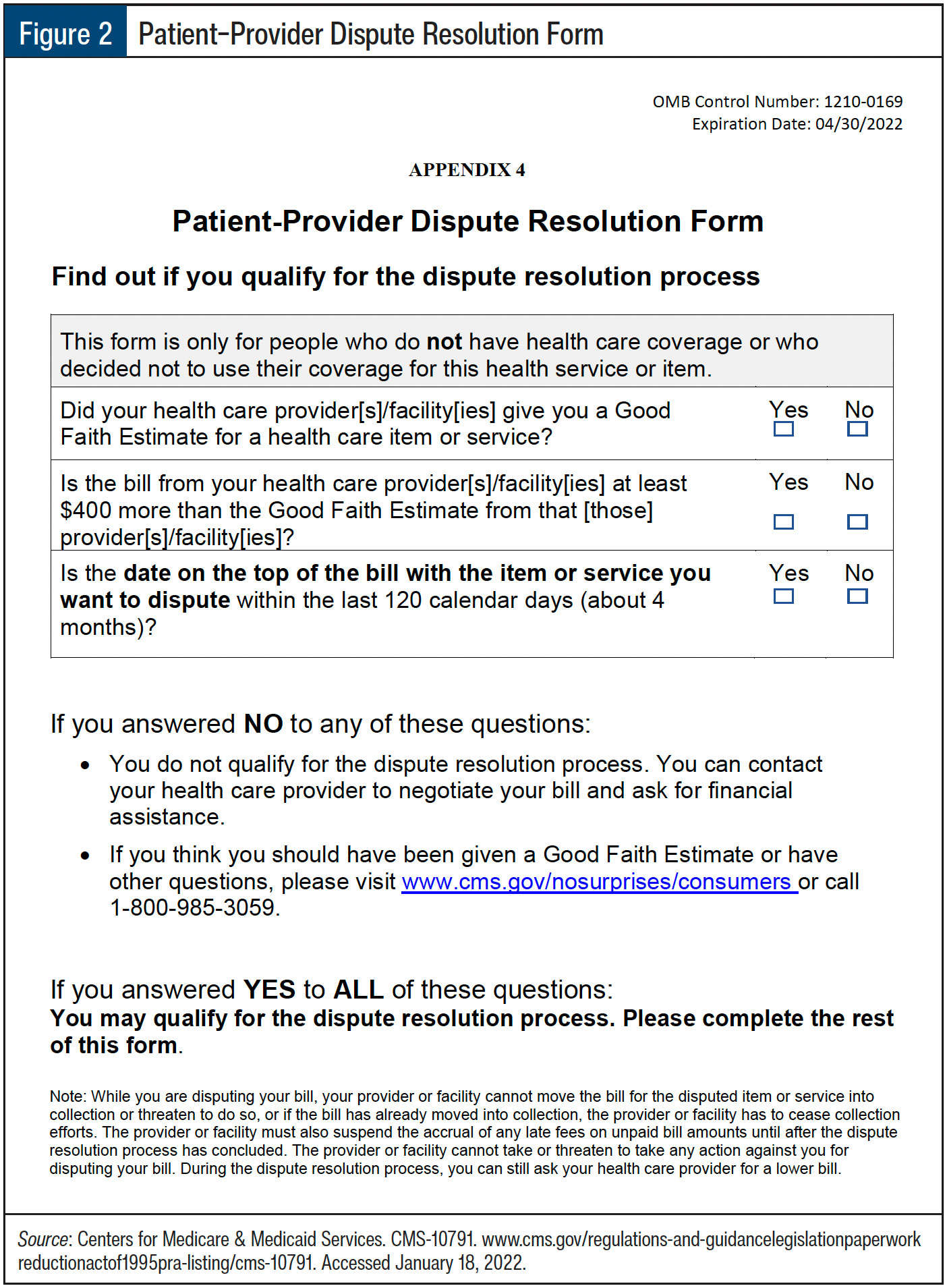

The No Surprises Act also implements a process by which patients can initiate a dispute for bills that substantially exceed the GFE provided, where “substantial” is defined as an increase of $400 or higher.2 HHS will choose 3 Selected Dispute Resolution Entities (SDREs) who will arbitrate disputes raised by patients (see Figure 2).

Patients will be required to pay an administrative fee to submit a dispute through an SDRE portal and they will need to meet specific requirements before qualifying to initiate a dispute.

Resources

As with most new requirements, ease of implementation is directly related to the resources available. For the No Surprises Act, there are several critical resources that will accelerate time to implementation and increase the likelihood of compliance with this regulation:

- Centers for Medicare & Medicaid Services (CMS) break down the No Surprises Act on their dedicated page at www.cms.gov/nosurprises.

- CMS also provides a full kit of resources for GFE and SDRE management, which has education and templates for use at www.cms.gov/regulations-and-guidancelegislationpaperworkreductionactof1995pra-listing/cms-10791, including:

- Right to receive a GFE of Expected Charges Notice (to post)

- GFE Template

- SDRE Declining Eligibility or Need More Information Notice

- Patient–Provider Dispute Resolution – Dispute Initiation Form

- Patient–Provider Dispute Resolution – Payment Settlement Form

- HHS – Appendix – Good Faith Estimate Data Elements

As always, reading through the regulations is highly recommended to ensure full understanding of the requirements on your facility and providers. For more information, go to CMS’ dedicated No Surprises Act website for an overview of the rule, summary fact sheets, provider resources, and more.

References

- MGMA. Implementing the No Surprises Act: federal regulation of surprise medical billing. November 9, 2021. www.mgma.com/resources/government-programs/implementing-the-no-surprises-act-federal-regulati. Accessed January 18, 2022.

- US Office of Personnel Management, Internal Revenue Service, Employee Benefits Security Administration, US Department of Health & Human Services. Requirements related to surprise billing; part 1. July 13, 2021. www.govinfo.gov/content/pkg/FR-2021-07-13/pdf/2021-14379.pdf. Accessed January 18, 2022.