Oncologists are operating in a whole new world as healthcare transitions to value-based care. To thrive in this emerging environment, providers must understand the many details involved in how value-based models work. Unlike fee-for-service payment models, the total cost of patient care plays a critical role in value-based reimbursement for an oncology practice.

Patients with chronic conditions, including cancer, are a major contributing factor to the ongoing rising cost of care, and the coding category Hierarchical Condition Category (HCC) is a mechanism to account for the additional care and subsequent added cost that these complex patients require.

HCC coding is a model to assess risk or risk adjustment that was designed by the Centers for Medicare & Medicaid Services to give weight, or value, to chronic conditions and comorbidities that contribute to overall healthcare costs.1,2

HCC coding is used to determine a risk-adjustment factor (RAF), a statistical tool that predicts the patient’s cost of care based on the provider-reported International Classification of Diseases, Tenth Revision (ICD-10) and HCC diagnosis codes. Certain ICD-10 codes qualify as an HCC, but not all ICD-10 codes are HCC conditions.

The more comorbidities (eg, hypertension, diabetes) are being managed throughout treatment and documented with HCC codes, the higher the RAF score. A high RAF score alerts Medicare and commercial payers that the expected cost of care for the patient will be higher than the benchmark for the primary condition.

In practice, the HCC model provides a more accurate projection of the patient’s expected overall cost of care and associated reimbursement when providers appropriately document the complexity of the patient’s healthcare.

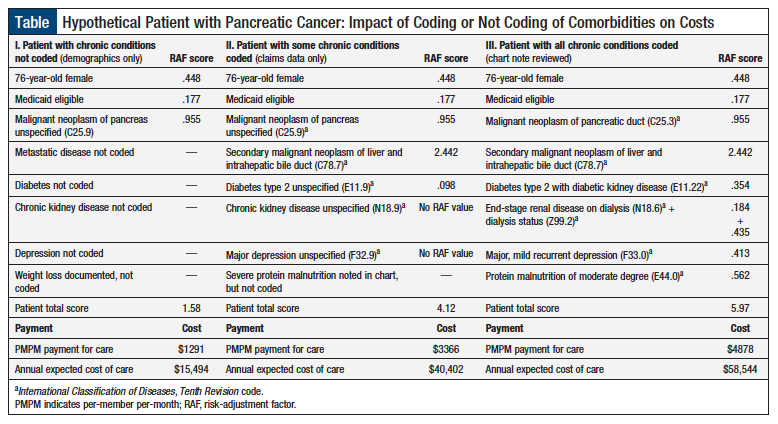

The Table shows the impact that HCC coding can have on the expected cost of a patient’s medical care. Specifically, this Table demonstrates anticipated costs for treating a hypothetical elderly patient with pancreatic cancer using 3 examples to show the inclusion or no inclusion of comorbidities. As shown in the Table, the RAF scores and the annual cost of care increase as more chronic conditions are documented.

HCC Coding in Value-Based Care

One critical way a physician can demonstrate high-quality, low-cost patient care in value-based contracts is through proper documentation with HCC codes. If the physician fails to document comorbidities that are being managed during treatment, and the cost of care is above the Medicare-established benchmark for the patient’s reported condition, the physician could be viewed as a low-value provider who delivers expensive care. If the physician is engaged in an at-risk payment model, they lose the opportunity for shared savings and may be at risk for incurring extra expenses.

Many oncologists underutilize HCC coding, even though they are assessing and caring for patients with different comorbidities. Many reasons can contribute to the inappropriate utilization of HCC codes, in addition to many misconceptions about how these codes affect revenue.

Dispelling Common Myths

A closer look at some of these misconceptions may help to dispel the myths surrounding HCC coding and may enable physicians to use this comprehensive coding system.

Myth: HCC codes are not the same as Current Procedural Terminology (CPT) codes and do not affect reimbursement.

Fact: Some physicians believe that entering HCC codes on the patient’s chart will result in increased reimbursement, which could subject them to a recovery audit contractor (RAC) audit for upcharging. The RAC program was created through the Medicare Modernization Act of 2003 to identify and recover improper Medicare payments to healthcare providers under fee-for-service Medicare plans. This assumption of increasing the chances of an RAC audit is incorrect, because HCC codes do not affect reimbursement, and are merely a way to demonstrate the complexity of the patient to payers so they can anticipate appropriate costs.

When a physician sees a patient, the physician enters a CPT code that reflects the complexity of the visit, which is completely independent of any HCC codes that may be entered on the chart. For example, if a physician enters a level 3 CPT code, and adds 4 HCC codes to identify various comorbidities that must be managed during treatment, the physician will still be paid for a level 3 visit based on the physician’s fee schedule.

Myth: HCC codes have implications for risk and shared-savings opportunities.

Fact: Although HCC codes do not change the physician’s reimbursement, they do have repercussions for physicians who participate in value-based contracts in which risks and cost-savings are shared. If the physician provides high-quality care at a lower-than-expected cost, the payer will often share the savings with participating providers.

Myth: If a comorbidity affects the treatment decision-making process, it should be documented.

Fact: Many physicians mistakenly think that they do not have to code for congestive heart failure, diabetes, hypertension, or other comorbidities, because they are not the principal or primary care physician who is managing those conditions. However, if the comorbidity influences the cancer treatment decision or is assessed during a visit in any way, it should be coded.

For example, a patient with poorly controlled diabetes may have 2 regimen choices (for diabetes), one that requires substantial steroid premedication and one that does not. All things being equal, it may be better to use a treatment with fewer steroids. The patient’s diabetes played a role in the medical treatment decision-making process, and therefore the physician should document it.

Regardless of whether oncologists are aware of it, they are constantly assessing patients’ comorbidities at each visit and are taking these conditions into account when making cancer treatment decisions. Every time they check the patient’s blood pressure, they are assessing for hypertension. If the oncologist reviews the patient’s hypertension medication, hypertension played a role in the medical decision-making, which should therefore be coded.

Contrary to what many physicians believe, they are not required to take any action, because patient assessment is considered an action in itself. Physicians assess their patients’ conditions automatically, but it is critical to step back and think about the medical decision-making that occurs, and then translate that into the appropriate documentation and coding.

Documenting/Reporting Comorbidities Efficiently

The best practice for documenting comorbidities is to capture them during the initial consultation, and then reflect on their implication during the development of the treatment plan, and in the future.

When submitting CPT codes for billing purposes, the associated comorbidities that influenced the initial treatment plan should be reported. If the plan is modified based on new or existing comorbidities, the revisions should be documented in a subsequent visit.

Comorbidities should be reviewed at every visit, but at least annually. Providers must make certain that comorbidities are documented on the chart annually, and this is reported to the payer. A patient can go from having diabetes one year to not having it the next year, according to payers, if no one coded for diabetes annually. A patient can even be an amputee one year and suddenly not be the next year if no one coded the condition as such.

Any physician treating the patient can enter HCC codes. Once the code is documented and the physician bills for services, the code stays with the patient. Many insurance companies pay for an annual physical examination with a primary care provider so that the clinician can gather data and make a plan for each comorbidity. This enables the insurance company to understand the complexity of the patient each year.

Capturing HCCs in an electronic health records (EHRs) system can be challenging, because several time-consuming steps may be required to input the code. McKesson Specialty Health’s iKnowMed Generation 2, an oncology-specific EHR used at our practice, documents HCC codes, along with other notes about the patients’ health and care plan.

Demonstrating the Patient’s Complexity Is Key

HCC codes are the only mechanism that enables oncologists to demonstrate to payers the complexity of their patients within their contracts. Consequently, it is important to understand how to use this unique coding system that provides the framework for reimbursement in the value-based care world.

Proper coding of comorbidities validates and substantiates the cost of high-quality care that patients receive, and also enables oncology practices to perform well in value-based care programs.

References

- Centers for Medicare & Medicaid Services. Risk adjustment fact sheet. 2015. www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/PhysicianFeedbackProgram/Downloads/2015-RiskAdj-FactSheet.pdf. Accessed August 7, 2018.

- Centers for Medicare & Medicaid Services. Diagnostic Cost Group Hierarchical Condition Category Models for Medicare Risk Adjustment: final report. December 21, 2000. www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/Reports/downloads/pope_2000_2.pdf. Accessed August 7, 2018.